H Beam Size Chart and Weight Table for Structural Design

8836Get a free H beam size chart, dimensions, and weight table for construction projects under global standards. CJM Steel supplies H beams - request a quote today.

View detailsSearch the whole station

In recent years, green steel has become one of the most discussed topics in the global steel market. Buyers, especially in Europe and developed economies, are increasingly demanding sustainable and low-carbon materials. But what is green steel? In simple terms, it refers to steel produced with significantly reduced carbon emissions, often using renewable energy and innovative production technologies.

For exporters, the shift toward sustainability is not just a trend—it is reshaping international trade. Those who fail to adapt may face higher tariffs, loss of competitiveness, or even barriers to entering key markets.

One of the strongest drivers for the adoption of green steel production is government policy.

For steel exporters, this means that “business as usual” is no longer an option. Adapting supply chains is essential to remain competitive in the EU and UK markets.

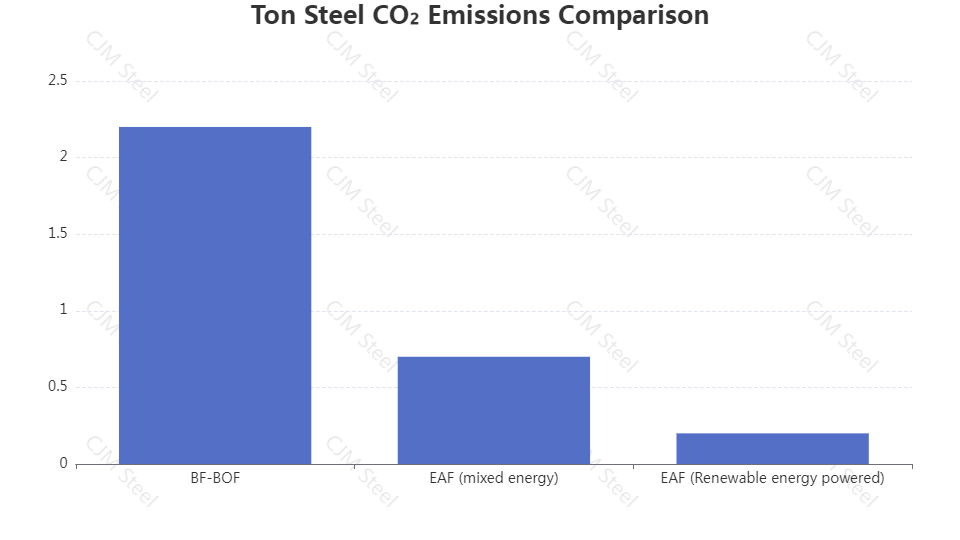

Not all steel is the same when it comes to carbon emissions.

This significant gap explains why EAF steel production are widely regarded as the most promising path toward decarbonization.

At the same time, many buyers are asking specifically for low carbon steel. Whether used in construction, manufacturing, or energy projects, low carbon steel helps companies meet their own sustainability commitments.ity commitments.

Sustainability is no longer only about regulations—it is also about buyer preference.

By working with mills and partners focused on green steel production, exporters can directly align with these market demands.

So, how can exporters prepare for this transition?

For exporters, the move toward green steel and low carbon steel is both a challenge and an opportunity. By adapting supply chains, complying with EU CBAM and UK CBAM, and aligning with buyers’ sustainability goals, exporters can not only avoid penalties but also gain a competitive edge.

Sustainability is no longer optional—it is the future of steel trade. Exporters who embrace this change today will be the leaders of tomorrow.

👉 Looking for a reliable partner in steel export? Contact us to explore sustainable steel solutions for your projects.

Get a free H beam size chart, dimensions, and weight table for construction projects under global standards. CJM Steel supplies H beams - request a quote today.

View detailsConstruction machinery such as excavators, bulldozers, and concrete mixers operates in harsh environments where surfaces are exposed to constant wear and impact. One of the most effective ways to extend the service life of these machines is by u...

View detailsCarbon steel pipe is strong, durable, and widely used for transporting fluids and gases in various industries.

View detailsExplore the exact checkered steel plate options for stairs, trailers & factory floors. Compare by thickness, pattern & price. Expert guide from CJM.

View details

HelloPlease log in